During a time of change and uncertainty that is often synonymous with the healthcare industry, strategies that cut costs without compromising quality of care are highly sought after by all third-party payers. Site of Care (SOC) Optimization is one of the top proven strategies for reducing the cost of specialty biologic medications. A SOC optimization strategy encourages patients to move from higher-cost settings, like big hospitals and institutions, to lower-cost settings, such as physician’s in-office infusion suites or stand-alone Infusion Centers. Insurance companies and Medicare have been moving forward with SOC optimization policies that are driving patients out of the hospital setting. Unfortunately, they are at the same time, creating policies that discourage physicians and infusion centers from expanding their infusion services.

The situation is comparable to leading a horse to water while simultaneously draining the pond.

The economics of healthcare and medication delivery are complicated. The government and private sectors employ thousands of workers who are trying to find ways to improve care and reduce costs through innovative and complex initiatives. Meanwhile, there is a widely-accepted alternative to hospital infusion that enhances quality of care while reducing the cost of care.

Why is a Site of Care Optimization strategy so attractive?

SOC Optimization is now one of the top strategies being used by payers nationwide to improve access to, and lower the cost of care. The reason for this adoption is that SOC strategies are effective and are supported by good data.

Hospital-based inpatient and outpatient Infusion Centers are exponentially more expensive than the physician-based and stand-alone Infusion Centers. Magellan’s annual Medical Pharmacy Trend Report consistently highlights this data.

“Commercial medical benefit drug costs in the hospital outpatient setting were often double that of the physician office. Compared to the commercial population…Oftentimes, administrative code reimbursement is four times more expensive in the hospital than physician office setting for commercial members; for Medicare, it is frequently twice as costly in the hospital.[1]”

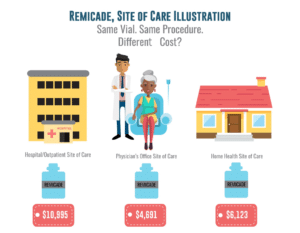

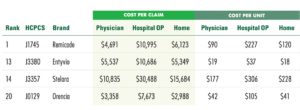

Looking at one of the most commonly prescribed biologics, Remicade (infliximab) from Johnson & Johnson, there is an apparent cost disparity between the hospital and physician office setting. The below table from Magellan’s 2017 Medical Pharmacy Trend Report highlights the clear discrepancy in cost among sites of care. The exact same medication, administered with the same method, is more than two times more expensive in the hospital setting.[2] Other specialty medications can be three to four times more expensive in the same scenario.

Several insurers have validated the effectiveness of a SOC Strategy. In the last two years, Medicare has been considering SOC parity policies (site neutral reimbursement), and United Healthcare’s (UHC) landmark national policy change in 2017 requires many expensive specialty biologics to be administered in a non-hospital setting.

Site of Care Optimization Sounds Great, What’s the Problem?

As insurance companies and government regulators are strongly encouraging these patients to move out of the hospital setting, they are simultaneously reducing physicians’ capability to provide these services in their office settings through restrictive utilization policies and declining reimbursements.

There are several contributing factors that are inhibiting the expansion of physician office sites of care.

Payers are Reducing Medication Margin for Physicians

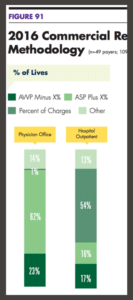

Since 2006, even though medication prices have steadily risen, the providers’ medication margins have been on a steady decline for both commercial and Medicare treatments. Most commercial payers have moved from an Average Wholesale Price (AWP) +/- model to an Average Sales Price (ASP) + reimbursement model. At the same time, most hospital reimbursement models remain at an AWP +/- and many (54% in 2016) still receive a percentage of charges model.[2]

The medication reimbursement formula for providers attempts to approximate the Average Sales Price of a medication by the time it reaches the physician, then adds 6% (ASP+6%). The problem is that this formula considers all the upstream discounts that everyone else receives ahead of the physician, leaving the physician at the end of a long chain of discount takers. In some cases, even after a +6% add-on, the provider can be left at break-even or a loss on their medication margins. As a result of budget sequestration in Medicare programs, the +6% was reduced to +4.3%, further reducing the treatment margin for the provider.

Payers are Paying Less for Procedure Reimbursements and Down Coding Claims

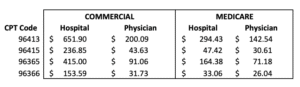

There is, and has been for some time, a large discrepancy between hospital outpatient and physician office reimbursement for administering specialty infusion and injections. Looking at 2017, the hospital reimbursement across both commercial and Medicare payers is drastically higher than physician reimbursements for infusion procedures. Below is a table detailing the discrepancy in reimbursement between hospital and physician sites of care for the same Current Procedural Terminology (CPT) codes. [1]

Despite this well-known fact, both commercial and Medicare payers have been steadily decreasing procedure payments to physician offices for over a decade.

The additional problem of the down coding of procedure payments is now common among payers. When the 96413 CPT code was created in 2006, it could be used on all chemotherapy medications and was also allowed to be used for most complex biologic and specialty medications. Over the last decade, many commercial payers and individual Medicare Administrative Contractors (MAC’s) have severely limited the number of biologic medications they will reimburse under this higher paid code. Many are automatically down coding claims submitted with 96413, 96415 codes to the lower paid 96365, 96366 codes. These codes are reimbursed at roughly one-third to half of the higher-level codes.

Payers are Increasing Physician Utilization Requirements

To control the utilization of these expensive medications in the physicians’ office setting, most commercial plans have continued to layer on multi-step utilization controls including step therapy (fail-first) policies, pre-authorization and pre-determination requirements, and various formulary/coverage restrictions. All these controls require a significantly higher effort on the part of the physician’s office staff to complete additional forms, submit letters of medical necessity, and provide medical records to support their decision to administer these medications.

In a growing number of offices, commercial plans are requiring the physician to coordinate with an outside specialty pharmacy to provide the patients medications to their office setting. This “specialty pharmacy requirement” is a big problem for providers as it requires yet another care coordination workload on their office staff since each patient dose and delivery must be coordinated with the outside pharmacy. It doesn’t help that most of the commercial payers who require specialty pharmacy involvement also own these pharmacies where they receive rebates from the manufacturers on these medications. These specialty pharmacy requirements also take margin away from the physician since they cannot “buy and bill” medications.

None of these extra utilization or specialty pharmacy coordination efforts are reimbursed by the current procedure codes allowed to be billed by the physician. However, these additional required steps greatly increase the overhead and workload for the provider’s office staff.

Summary

All the data points to a very simple economic solution. If we want to quickly and drastically reduce the burden of these specialty medications to the healthcare system and the patients who share these higher costs, then we must optimize the site of care.

Moving patients from the hospital to the physician-office or stand-alone infusion center setting is a proven win-win strategy that decreases both the medication cost and procedure cost of treatment and reduces the profit incentives of hospitals and institutions. (including misused 340B programs)

There has been a lot of talk lately among the leadership at CMS and HHS about updating the payment models to not incentivize providers who are proving this in-office medication delivery services. Ironically, incentivizing and enabling the physician-office / stand-alone infusion center setting is EXACTLY what needs to be done if we want to reduce the cost of delivering these specialty medications. We need to reverse the current trend of decreasing medication and procedure margins and reduce the burden of utilization controls that are disincentivizing physician-offices and stand-alone infusion center operators from expanding their services and offerings.

Conclusion

Policies and strategies that reduce physician and stand-alone infusion center incentives is bad economics and runs against the grain of what the data shows us. The last thing we need to be doing in healthcare delivery is to create policies that drive patients away from the optimal sites of care and into hospital and instituational settings.

Sure, there are probably several macroeconomic master plans that could eventually solve the long-term issues with medication delivery costs in our healthcare system. For now, SOC optimization through the physician-based office and stand-alone infusion center and increasing reimbursement for these providers is the most common-sense win-win approach to quickly reducing specialty biologic delivery cost in our healthcare system.

[1] Magellan Health Insights. The Trends and Complexities of Provider-Administered Drugs. https://magellanhealthinsights.com/2016/11/03/the-trends-and-complexities-of-provider-administered-drugs/. Published 2016. Accessed November 28, 2018.

[2] Magellan Rx Management. 2017 Magellan Rx Management medical pharmacy trend report. https://www1.magellanrx.com/magellan-rx/publications/medical-pharmacy-trend report.aspx. Published 2018. Accessed November 28, 2018

[3] UnitedHealthcare Commercial Utilization Review Guideline. Specialty medication administration-site of care review guidelines. https://www.uhcprovider.com/content/dam/provider/docs/public/policies/comm-medical-drug/specialty-medication-administration-site-care-review-guidelines.pdf. Published 2018. Accessed November 28, 2018.

[4] Magellan Rx Management. Medical pharmacy trend report. https://www.magellanhealth.com/wp-content/uploads/uploads/documents/sites/2/2019/03/b8d938de3f76b0e65e046b8d2e7c2811.pdf. Published 2016. Accessed November 28, 2018

Edited and illustrations by Amy Rios, Marketing and Communications Specialist at the National Infusion Center Association